Best Stock Market Index

In finance, a stock index, or stock market index, primarily measures the performance of a stock market or a subset of a stock market. Moreover, it serves as a tool for investors to analyze market trends and performance over time.. Furthermore, it helps investors compare current stock price levels with past prices so as to calculate market performance effectively.

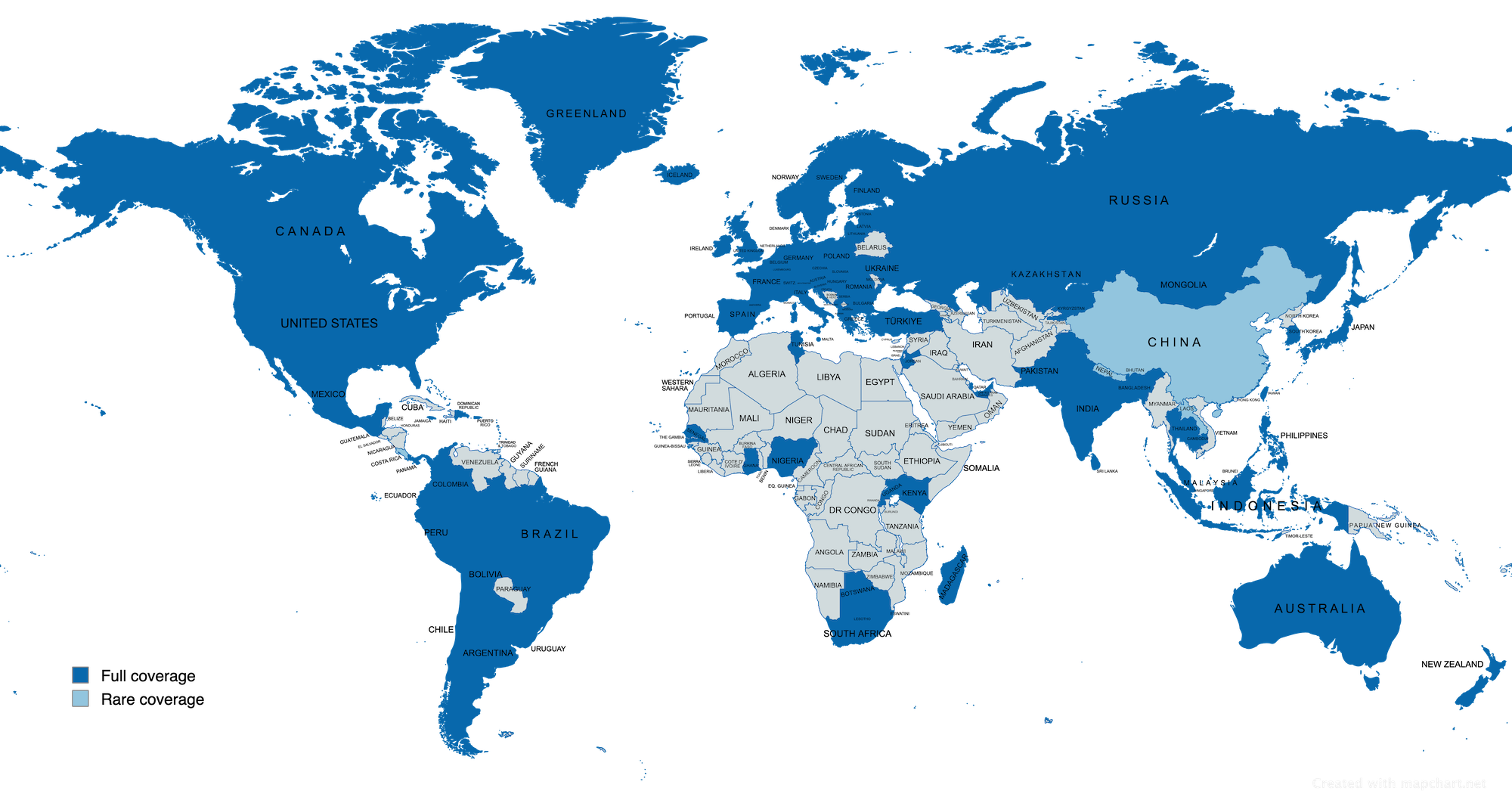

World or Global Coverage

In addition, these indices attempt to represent the performance of the global stock market. Best Stock Market Index

For instance, the MSCI World has nearly 1,400 constituents that cover approximately 85% of the free float-adjusted market capitalization in 23 developed countries. The FTSE Global Equity Index Series goes further down the market capitalization spectrum by including over 16,000 companies. The By contrast the S&P Global 100 is more limited with only 100. Best Stock Market Index

Regional Coverage

These indices represent the performance of the stock market of a single geographical region.

“The FTSE Developed Europe Index and the FTSE Developed Asia Pacific Index are examples of these indices.” “The capital asset pricing model approximates a market-cap weighted market portfolio using a market-cap weighted equity index portfolio.”

Country Coverage

“These indices represent the performance of a single country’s stock market, and by proxy, they reflect investor sentiment on the state of its economy.

The stocks of large companies listed on a nation’s largest stock exchanges compose frequently quoted national indices.” Examples include the S&P 500 Index in the United States, the Nikkei 225 in Japan, the DAX in Germany, the NIFTY 50 in India, and the FTSE 100 in the United Kingdom.”

Exchange-Based Coverage

“The exchange on which the stocks are traded, such as the NASDAQ-100, or groups of exchanges, such as the Euronext 100 or OMX Nordic 40, may form the basis for these indices.”

Sector-Based Coverage

These indices track the performance of specific market sectors Some examples are the Wilshire US REIT Index, which tracks more than 80 real estate investment trusts, and the NASDAQ Biotechnology Index which consists of about 200 firms in the biotechnology industry.

Market-Capitalization Weighting

This method weights constituent stocks by their market capitalization (often shortened to “market cap”), i.e the stock price multiplied by the number of shares outstanding.

“A mean-variance efficient portfolio can be expected to produce the highest available return for a given level of risk. One might also consider a market-cap weighted index as a liquidity-weighted index, because the largest-cap stocks tend to have the highest liquidity and the greatest capacity to handle investor flows; such stocks could give portfolios very high investment capacity.” Best Stock Market Index

Free-Float adjusted Market-Capitalization Weighting

This method adjusts each company’s market-cap index weight by excluding closely or strategically held shares that are not generally available to the public market. Such shares may be help by governments, affiliated companies, founders and employees.

Foreign ownership limits imposed by government regulation could also be subject to free-float adjustments. These adjustments inform investors of potential liquidity issues from these holdings that are not apparent from the raw number of a stock’s shares outstanding. Free-float adjustments are not easy to calculate, and different index providers have different free-float adjustment methods, which could sometimes produce different results.

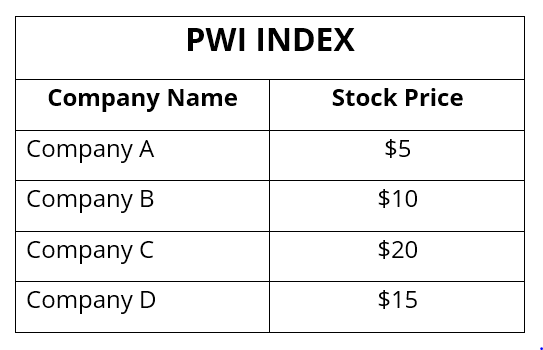

Price Weighting

This method weights each constituent stock by its price per share divided by the sum of the sum of all share prices in the index. A price-weighted index can be thought of as a portfolio with one share of each constituent stock. However, a stock split for any constituent stock of the index would cause the weight in the index of the stock.

That split to decrease, even in the absence of any meaningful change in the fundamentals of that stock. This feature makes price-weighted indices unattractive as benchmarks for passive investment strategies and portfolio managers. “Many investors widely follow price-weighted indices, such as the Dow Jones Industrial Average and the Nikkei 225, as visible indicators of day-to-day market movements.” Best Stock Market Index

That split to decrease, even in the absence of any meaningful change in the fundamentals of that stock. This feature makes price-weighted indices unattractive as benchmarks for passive investment strategies and portfolio managers. “Many investors widely follow price-weighted indices, such as the Dow Jones Industrial Average and the Nikkei 225, as visible indicators of day-to-day market movements.” Best Stock Market Index

Equal Weighting

This method gives each constituent stocks weights of 1/n, where n represents the number of stocks in the index. This method produces the least-concentrated portfolios. Equal weighting of stocks in an index is considered a naive strategy because it does not show preference towards any single stock.

Zeng and Luo (2013) notes that broad market egually weight indices are factor-indifferent and randomizes factor mispricing. Equal weight stock indices tend to overweight small-cap stocks and to underweight large-cap stocks compared to a market-cap weighted index. These biases usually result in higher volatility and lower liquidity than market-cap weight indices.