Factor Based Index Rolls Enhancing Factor Investing

Factor Based Index Rolls Enhancing Factor Investing: Investors often use factor-based index rolls to enhance factor investing, providing a more targeted and efficient approach to investing in specific market segments. These index rolls track the performance of specific factors, such as value or momentum, by selecting stocks that exhibit certain characteristics associated with those factors.

An investor can achieve this by either selecting stocks based on predefined criteria using a rules-based approach or employing a machine learning algorithm that analyzes historical data to identify stocks likely to exhibit the desired factor characteristics. For instance, an investor may create a portfolio providing exposure to both low risk and high return factors by combining a rolling factor-based index with a low volatility strategy.

There are several benefits to using factor based index rolls in factor investing. For one, they can help investors achieve more targeted exposure to specific factors, which can help them achieve their investment goals more efficiently. They can also help investors avoid some of the pitfalls associated with traditional market cap weighted indexes, such as concentration risk and over exposure to certain sectors or stocks.

Understanding Factor Investing

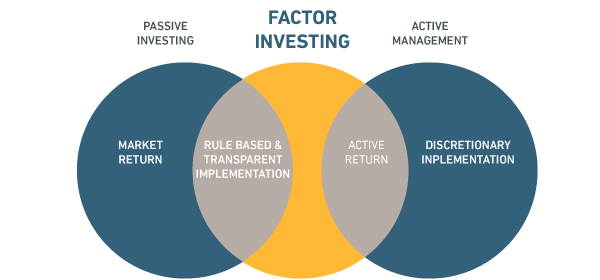

Factor Based Index Rolls Enhancing Factor Investing : Factor investing is becoming increasingly popular among investors, as it offers a more systematic and objective approach to portfolio construction. In essence, investors implement factor investing by targeting specific factors believed to drive market returns. Some of the most commonly targeted factors include value, momentum, quality, and size. By allocating capital to these factors, investors can potentially enhance returns and reduce risk.

However, it is important to note that factor investing is not a one size fits all approach. Different investors may have different objectives and risk tolerances, and factors or allocate capital differently. Furthermore, factors themselves can be nuanced and complex, and may behave differently in different market environments.

The Role of Factor Based Index Rolls in Factor Investing

Factor Based Index Rolls Enhancing Factor Investing : Factor investing is a popular investment strategy that aims to capture the performance of specific factors, such as value, momentum, quality, and size, in an attempt to outperform the market. While factor investing has been around for decades, it has gained popularity in recent years due to the growing availability of factor based investment products. One key element of factor investing is the use of factor based index rolls.

Definition: Factor-based index rolls track the performance of specific factors. For example, a value index roll tracks the performance of stocks deemed undervalued by the market. By using factor based index rolls, investors can gain exposure to specific factors that they believe will outperform the market.

Benefits: Factor based index rolls offer a number of benefits for investors. First, they provide a systematic approach to capturing the performance of specific factors. This can help investors avoid the pitfalls of behavioral biases, such as overconfidence or herd mentality. Second, factor based index rolls can be used to enhance the diversification of a portfolio.

Challenges: While factor based index rolls offer many benefits, there are also some challenges to consider. One challenge is the potential for tracking error. Because factor-based index rolls aim to track specific factors, they may not capture the exact performance of those factors due to market fluctuations or other influences.

Examples: There are many different factor based index rolls available to investors, each designed to track a specific factor. For example, the iShares MSCI USA Value Factor ETF (VLUE) tracks the performance of U.S. Large and mid cap stocks that exhibit value characteristics.

How it Works?

Factor Based Index Rolls Enhancing Factor Investing : Here are some key points to know about how rolling factor based indexes work:

They use a rolling window approach: Rolling factor based indexes typically use a rolling window approach to calculate factor returns. This means that the index is rebalanced at regular intervals, such as every month or every quarter, and the returns are calculated over the previous rolling period, such as the previous year or the previous six months.

They can be based on different factors: Rolling factor based indexes can be based on a variety of different factors, such as value, momentum, quality, and low volatility. The choice of factor will depend on the investor’s objectives, risk tolerance, and investment horizon.

They can be used to manage risk: Investors use rolling factor-based indexes to manage risk by providing more diversified exposure to factors over time. By investing in a rolling factor based index, investors can avoid the risk of investing in a single factor that may under perform over a given period.

They can be combined with other investment strategies: Investors combine rolling factor-based indexes with other investment strategies, such as smart beta or active management, to create customized portfolios that meet their objectives and risk tolerance. For example, an investor may create a portfolio that provides exposure to both low risk and high return factors by combining a rolling factor-based index with a low volatility strategy.

Summary

Factor Based Index Rolls Enhancing Factor Investing : In summary, rolling factor based indexes provide investors with a more dynamic and flexible way to access factor returns by using a rolling window approach to calculate factor performance. Investors can base these indexes on a variety of different factors, using them to manage risk and create customized portfolios.

By understanding how rolling factor based indexes work, investors can better capture the time varying nature of factor returns and adjust their investments accordingly.