Stock Market Index Hits Trillion Dollar Milestone

Stock market index hits trillion dollar milestone : The world has its first $1 trillion stock fund. Vanguard Total Stock Market Index VITSX.

As of Nov 30, the Vanguard fund had $1,035,112,935,440 in assets. Launched in 1992, the Vanguard fund which has both traditional open end mutual fund share classes and an exchange traded fund share class is designed to be a core holding for investors, providing them exposure to the entirety of the U.S. stock market.

The fund has come a long way since its launch in 1992. By the end of that first year, it had $512 million in assets, and since then it has grown to over 2,000 times that size, riding the trend of investors seeking out low cost, broad based building blocks for their portfolios.

Vanguard Total stock Market Index gives investors exposure to the entirety of the U.S. stock market, with more 3,590 stock Market Index is one of the best core U.S. stock funds available, said Morningstar’s director of global ETF research Ben Johnson. Broad diversification, a rock bottom fee, and the backing of a capable steward of fund shareholder capital in vanguard set it up for continued success. The fund carries a Morningstar Analyst Rating of Gold.

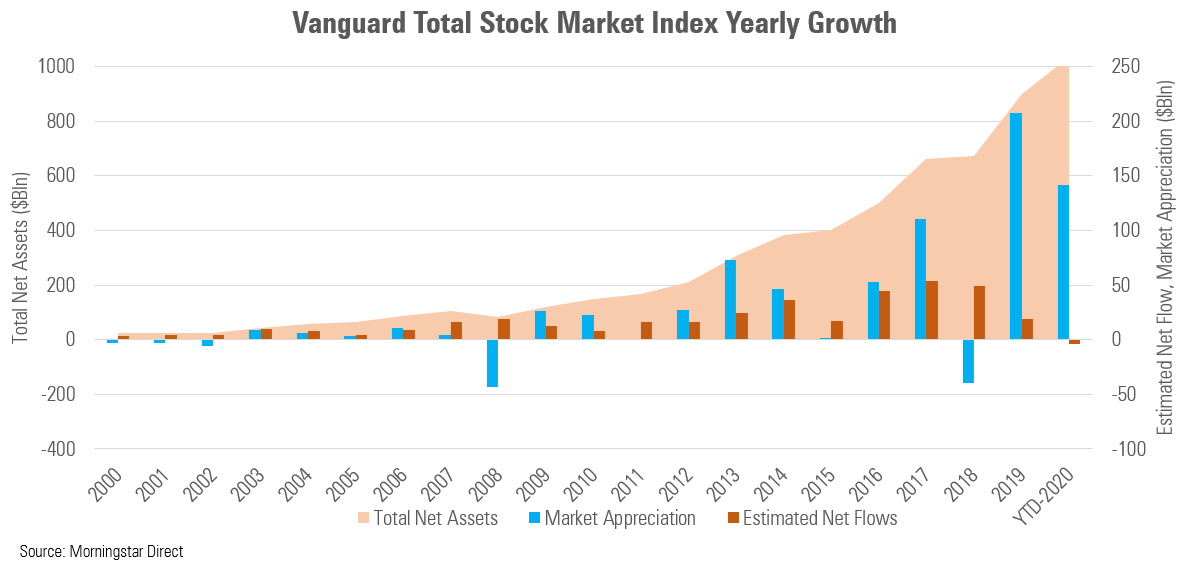

Since its launch, the fund has never had a year of outflows. That streak has been in jeopardy in 2020, however. With one month left in the year, it has seen $3.7 billion in outflows.

Despite its impressive streak of inflows, the increase in the value of the stocks the fund owns has driven most of the fund’s growth since 2009. Only in 2011, 2015 and 2019 did flows contribute more to the increase in the fund’s assets than the appreciation of the portfolio.

Vanguard Total Stock Market Index Yearly Growth

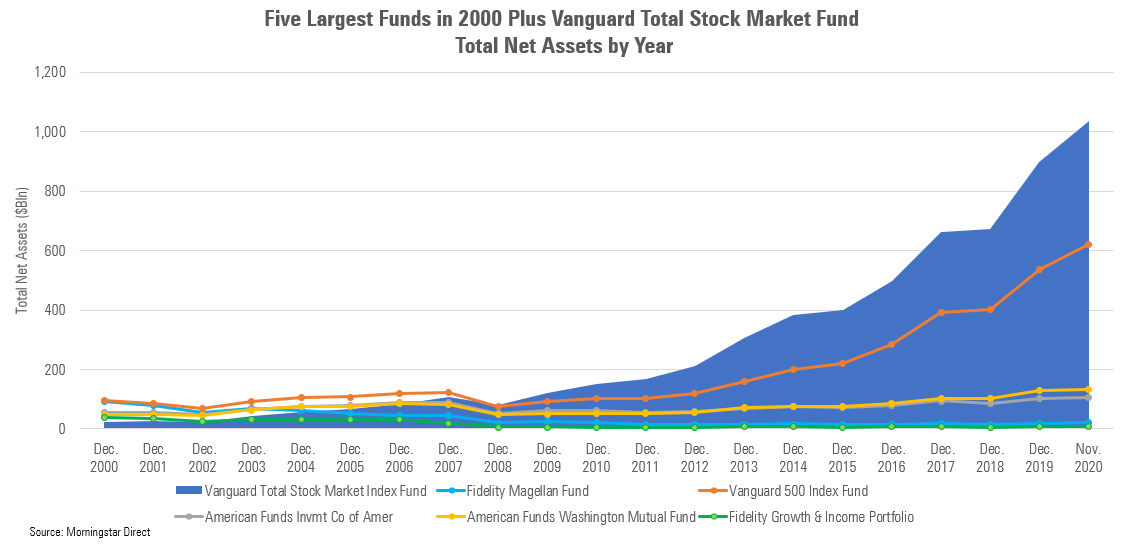

Stock market index hits trillion dollar milestone : To put the fund’s growth in perspective, we’ve gone back 20 years and looked at the five largest funds at the time. The largest was vanguard 500 index VFINX, American Funds Investment Company of America AIVSX, American Funds Washington Mutual AWSHX, and Fidelity Growth and income FGRIX.

Largest Funds in 2000 Plus Vanguard Total Stock Market Fund

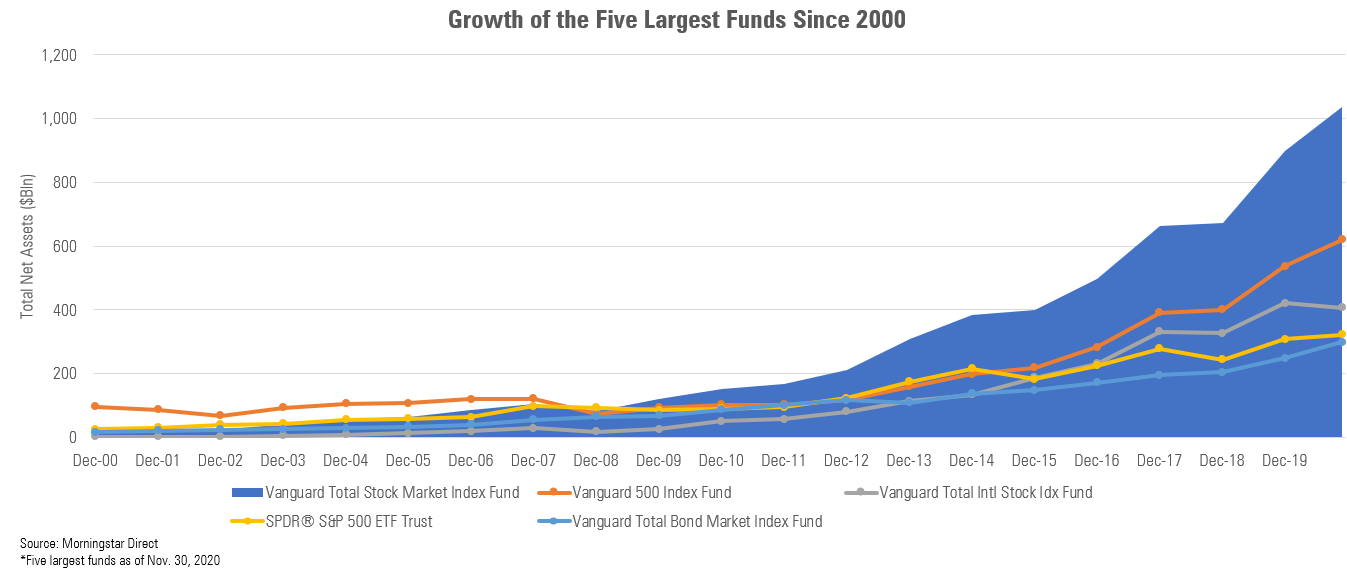

Stock market index hits trillion dollar milestone : Reflecting the shift toward index investing, of the top five back in 2000, only one of those vanguard 500 Index remains on that largest funds list today. The five largest funds today are all passively managed.

Growth of the Largest Funds Since 2000

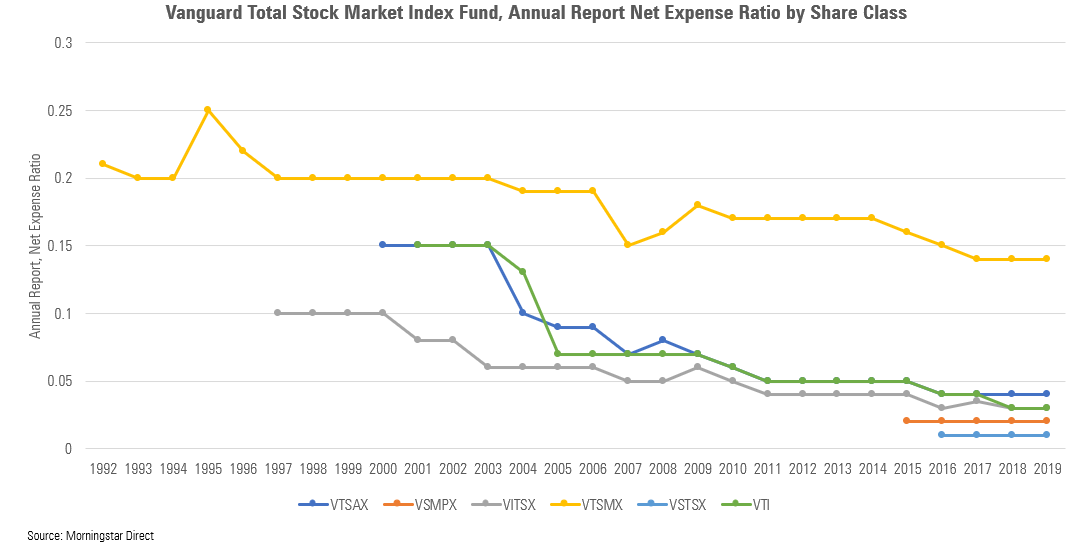

Stock market index hits trillion dollar milestone : Costs have been a key driver of the shift to passively managed funds. The four funds left in the dust by vanguard Total stock Market Index denoted below in yellow have much higher fees than the index funds that have supplanted them at the top of the asset ranks. The following chart compares the funds based on expense ratios, organic growth rates, and assets under management.

Vanguard Total Stock Market Index Fund

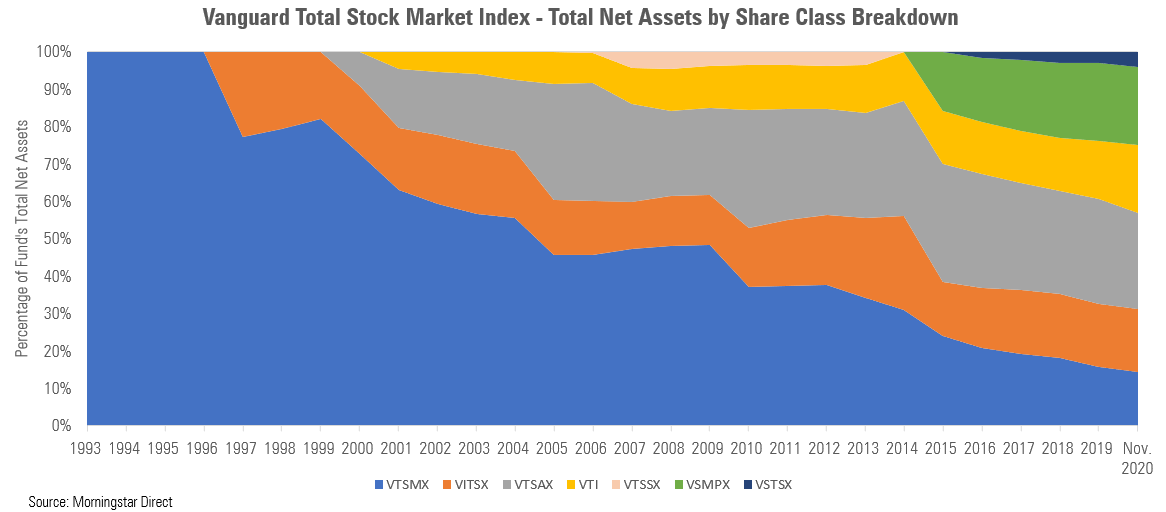

Stock market index hits trillion dollar milestone : Over time, the distribution of assets across the fund’s share classes has also evolved. Today, 26% of its assets sit in its Admiral share class. The Institutional share class, which was created in 2016, now comprises 21% of the fund’s total net assets.

Vanguard Total Stock Market Index

With its strategy of capturing the entirety of the U.S. stock market, the evolution of the fund’s sector exposure since launch offers a window into the changing complexion of the as performance has ebbed and flowed among different sectors.

Summary

The rise and fall and rise again of technology stocks is among the clearest of trends. As of the end of October, the fund had 23.4% of its portfolio in tech stocks, compared with its 7.9% weighting in September 1992. In recent years the presence of energy stocks has diminished presence. That sector made up just 1.9% of the portfolio at the end of October, down from the 14.8% stake as of August 2008, when the price of oil flirted with $150 per barrel.